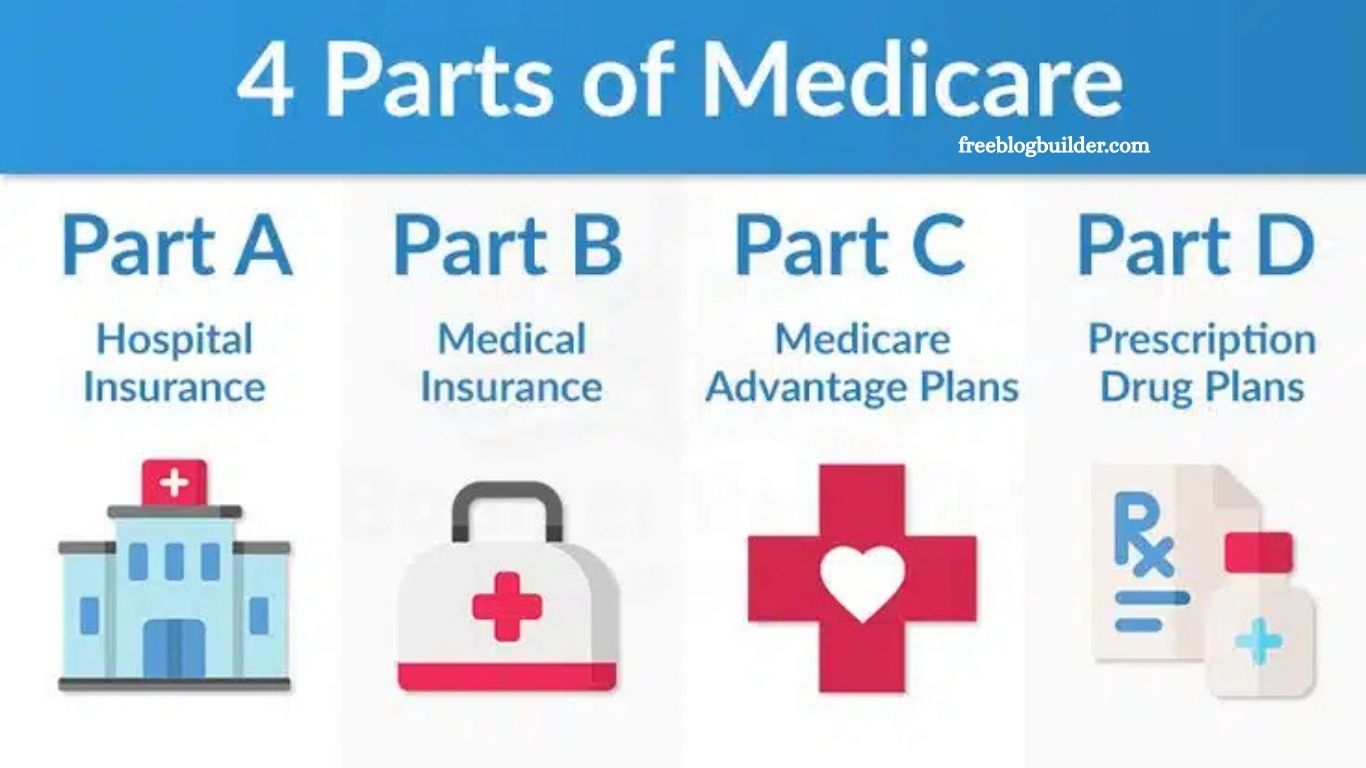

Medicare offers several parts designed to cover different aspects of your healthcare needs. Part A helps pay for hospital stays and inpatient care, while Part B covers outpatient services such as doctor visits, preventive care, and medical equipment. Part C, also known as Medicare Advantage, is offered through private insurers and usually combines the benefits of Parts A and B, often with extra services. Part D provides prescription drug coverage, either as a stand-alone plan or included in most Medicare Advantage options.

If you’re unsure whether to stick with Original Medicare and add a separate Part D plan, or to choose a Medicare Advantage plan that bundles coverage, this guide will walk you through the details.

Read More: Official Price Revealed for the Xbox Handheld

What is Medicare Part C?

Medicare Part C, also called Medicare Advantage, is offered through Medicare-approved private insurance companies. These all-in-one plans combine the benefits of Part A (hospital insurance) and Part B (medical insurance), while often adding extra coverage such as dental, vision, hearing, and prescription drugs.

Cost

Costs for Medicare Advantage vary depending on the insurer, plan type, and location. Many plans require a monthly premium in addition to your Part B premium, though some have no monthly premium. It’s important to compare both costs and benefits before enrolling.

Eligibility

Anyone enrolled in Original Medicare (Parts A and B) is eligible to join a Medicare Advantage plan.

What is Medicare Part D?

Medicare Part D is an optional prescription drug benefit available to all Medicare enrollees. It adds drug coverage to Original Medicare, as well as certain Medicare Cost Plans, Private Fee-for-Service (PFFS) plans, and Medicare Medical Savings Account plans. These plans are offered by Medicare-approved private insurers.

Cost

Monthly premiums for Part D vary by plan and provider. In 2026, the national base beneficiary premium is $38.99. Higher-income enrollees may pay an additional surcharge. Part D also has an annual out-of-pocket spending limit for covered drugs—$2,000 in 2025 and $2,100 in 2026.

Eligibility

You can enroll in Part D when you become eligible for Medicare. Delaying enrollment may result in a permanent late enrollment penalty, unless you qualify for the Extra Help program, which assists those with limited income and resources.

Can You Enroll in Both Medicare Part C and Part D?

You generally cannot be enrolled in both Part C and Part D at the same time. Most Medicare Advantage (Part C) plans already include prescription drug coverage. If you join a separate Part D plan while enrolled in a Medicare Advantage plan with drug coverage, you’ll be automatically disenrolled from Part C and returned to Original Medicare.

To explore your options, the Centers for Medicare & Medicaid Services (CMS) offers a Medicare Plan Finder at Medicare.gov

. This tool allows you to compare drug plans and Medicare Advantage plans available in your area based on costs, coverage, and providers.

Frequently Asked Questions

What is the difference between Medicare Part C and Part D?

Part C (Medicare Advantage) combines hospital and medical coverage and often includes drug, dental, and vision benefits. Part D only provides prescription drug coverage.

Can I switch from Part D to Part C?

Yes, but you must wait for the Medicare Annual Enrollment Period (Oct. 15 – Dec. 7) or other qualifying enrollment periods.

Do all Medicare Advantage (Part C) plans include drug coverage?

Most do, but not all. Always check the plan details before enrolling.

What happens if I miss enrolling in Part D when first eligible?

You may face a permanent late enrollment penalty unless you qualify for the Extra Help program.

Can I have both a Part C plan and a separate Part D plan?

No. If your Part C plan already includes drug coverage, enrolling in a separate Part D plan will move you back to Original Medicare.

How do I find the best plan for my needs?

Use the Medicare Plan Finder at Medicare.gov

to compare coverage, costs, and participating providers in your area.

Conclusion

Choosing between Medicare Part C and Part D depends on your healthcare needs, budget, and coverage preferences. Medicare Advantage (Part C) offers bundled benefits, often including drug, dental, and vision coverage, while Part D focuses solely on prescription drugs and can be added to Original Medicare. Since you cannot be enrolled in both Part C with drug coverage and a separate Part D plan at the same time, it’s important to carefully compare your options.